IPO 2021

IPO 2021 - First North

The initial public offering of Lamor on First North Premier was oversubscribed and the listing completed as planned

- The Board of Directors of Lamor Corporation Plc decided on 7 December 2021 on the completion of the initial public offering.

- The subscription price for the offer shares was EUR 4.83 per share in the institutional offering and the public offering, and EUR 4.35 per share in the personnel offering, which in total corresponds to a market capitalisation of approximately EUR 130 million for Lamor immediately following the offering.

- In the offering, Lamor issued 7,281,374 new shares, corresponding to approximately 27.0 per cent of the total number of issued and outstanding shares in Lamor after the offering.

- Lamor received gross proceeds of approximately EUR 35.0 million from the offering.

- Demand in the offering was extremely strong from both Finnish and international investors and the offering was oversubscribed multiple times. In the public offering, subscriptions were received from over 10,000 investors.

- The number of shareholders in Lamor increased to over 10,000 shareholders after the offering.

- Trading in the shares in Lamor commenced on Nasdaq First North Premier Growth Market Finland maintained by Nasdaq Helsinki Ltd on 8 December 2021.

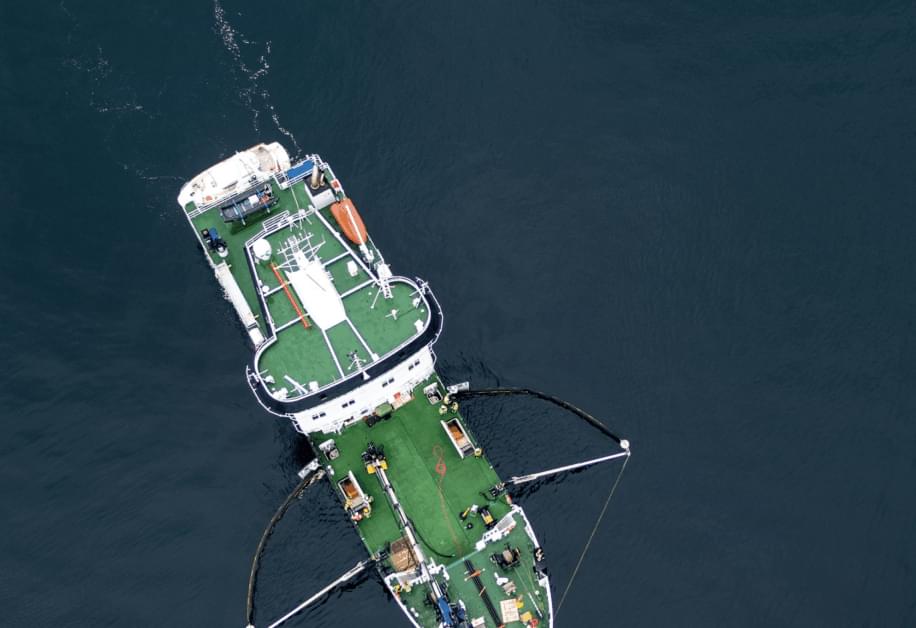

Lamor is one of the leading global providers of environmental solutions

Lamor is a family company incorporated in 1982 in Finland offering expertise and solutions for the protection and cleaning of the environment and ecosystems. Lamor’s mission is to clean the world, which is demonstrated through its three business areas: oil spill response, waste management and water treatment. Lamor’s business is divided into the equipment business and the service business.

Lamor operates in over 100 countries through its subsidiaries and associated companies, as well as its partner and distribution network. Lamor has subsidiaries and associated companies in 21 countries, and it operates in all continents.

From the CEO

“Lamor is one of the leading global providers of environmental solutions. Our solutions and expertise are designed to protect the environment and ecosystems – globally but locally. The global environmental challenges of one are the challenges of us all. Thus, we have always believed that the only way to solve them is together.

We strive to respond to the growing global environmental awareness that creates demand for sustainable solutions for soil and water clean-up. Our goal is to combat climate change extensively by developing solutions that enable our customers to better prepare for environmental challenges, acting as a trusted partner in environmental clean-up projects and providing solutions that help our customers better meet their circular economy targets. Our vision is a clean tomorrow, where future generations will enjoy clean water and clean soil.

As a part of our growth strategy, Lamor is committed to the execution of increasingly material and impactful projects. During 2020 and 2021 alone, we have entered into four significant long-term service agreements and the company’s order backlog has grown more than 10-fold between the end of December 2020 and the end of September 2021.

Let’s clean the world together!“

Mika Pirneskoski

CEO

Lamor's strengths

- Significant future opportunities for the Company’s solutions promoting sustainability

- Wide offering and global network support implementation of demanding projects

- Wide and satisfied clientele and order backlog consisting mainly of projects for clients in the public sector

- Excellent success rate in tenders of the public sector enables fast expansion of the business

- Strong financial profile supports the pursuit of future growth

First North Premier IPO

Lamor Corporation aims to raise gross proceeds of approximately EUR 35 million by offering a maximum of 7,266,253 new shares in the company for subscription.

The offer shares may represent up to approximately 27.0 per cent of the issued and outstanding shares in the company after the offering, assuming that the company will issue the preliminary maximum number of new shares in the offering and that the over-allotment opption will not be exercised (approximately 31.0 per cent of the shares, assuming that the company will issue the preliminary maximum number of new shares in the offering and that the over-allotment option will be exercised in full). As a result of the offering, the number of issued and outstanding shares in the company may increase to up to 26,944,853 shares assuming that the company issues 7,266,253 new shares in the offering

The Offering consists of

- a public offering to private individuals and entities in Finland and

- an institutional offering to institutional investors in Finland and, in accordance with applicable laws, internationally outside the United States as well as

- personnel offering to the company’s employees, Management Team, CEO and Board of Directors.

Danske Bank A/S, Finland Branch acts as the sole global coordinator and will act as Lamor’s certified adviser.

Use of proceeds

Lamor intends to use the net proceeds from the offering to strengthen its capital structure. Strengthening of the capital structure will improve Lamor’s capabilities to implement its growth strategy through financing of new larger projects, investments in technologies and expansion of the geographical network.

Cornerstone Investors

Danske Invest Finnish Equity Fund, Mandatum Asset Management Ltd, certain funds managed by SP-Fund Management Company Ltd and Veritas Pension Insurance Company Ltd have, subject to certain conditions, committed to subscribing shares for in aggregate EUR 19.5 million in the offering, provided that the valuation the company’s outstanding shares before any proceeds from the offering does not exceed EUR 95 million.

The Public Offering 25 November – 2 December 2021

Preliminarily a maximum of 1,000,000 offer shares are offered in the public offering to private individuals and entities in Finland. Depending on the demand, the company may reallocate offer shares between the public offering, the institutional offering and the personnel offering in deviation from the preliminary number of offer shares without limitation.

However, the minimum number of offer shares to be offered in the public offering will be 1,000,000 offer shares or, if the aggregate number of offer shares covered by the commitments submitted in the public offering is smaller than this, such aggregate number of offer shares as covered by the commitments.

Subscription price in the public offering

EUR 4.83 per offer share

Commitments in the public offering

no less than 150 and no more than 25,000 shares

Subscription places in the public offering

Danske Bank’s customers with a book-entry account or an equity savings account

- Danske Bank’s eBanking service with bank identifiers for private customers at www.danskebank.fi/lamor-en;

- Danske Bank’s corporate eBanking services in the Markets Online module for District customers;

- Danske Bank’s Investment Advisory Center with Danske Bank’s bank identifiers by phone 9:00 a.m. to 6:00 p.m. (Finnish time) Monday to Friday, tel. +358 200 20109 (local network charge / mobile charge). Calls to the Danske Bank Investment Advisory Center are recorded;

- Danske Bank offices in Finland during normal business hours; and

- Danske Bank’s Private Banking offices in Finland (for Danske Bank’s Private Banking customers only).

Making a commitment by phone using Danske Bank’s Investment Advisory Center or Danske Bank’s eBanking service requires a valid eBanking agreement with Danske Bank.

Subscriptions to equity savings accounts can be made through Danske Bank only to an equity savings account provided by Danske Bank.

For customers of other banks

- Online subscription at www.danskebank.fi/lamor-en for private customers. An internet subscription requires bank identifiers of Aktia, Danske Bank, Handelsbanken, Nordea, Oma Savings Bank, OP Group, POP Bank, S-Bank, Savings Bank or Ålandsbanken; and

- Danske Bank’s offices (excluding corporate offices) in Finland during normal business hours. Information on the offices offering subscription services is available by phone using Danske Bank’s Investment Advisory, 9:00 a.m. to 6:00 p.m. Monday to Friday (Finnish time), tel. +358 200 20109 (local network charge/mobile charge) or online at www.danskebank.fi. Calls to Danske Bank are recorded.

Nordnet’s book-entry account and equity savings account customers

- Nordnet’s online service at www.nordnet.fi/fi/lamor.

- A Commitment submitted through Nordnet’s online service requires personal user identifiers of Nordnet. A Commitment can also be made on behalf of a corporation through Nordnet’s online service. A subscription to equity savings account can be made through Nordnet only to equity savings accounts provided by Nordnet.

Important dates

| The subscription period for the public offering, the institutional offering and the personnel offering commences | 25 November 2021 at 10:00 a.m. |

| The subscription periods for the public offering and the personnel offering end | 2 December 2021 at 4:00 p.m. |

| The subscription period for the institutional offering ends | 7 December 2021 at 11:00 a.m. |

| The results of the offering will be announced | On or about 7 December 2021 |

| The offer shares allocated in the public offering and the personnel offering will be recorded in the book-entry accounts of the investors | On or about 8 December 2021 |

| Trading in the shares on First North Premier is expected to commence | On or about 8 December 2021 |

| The offer shares allocated in the institutional offering will be ready to be delivered against payment through Euroclear Finland | On or about 10 December 2021 |

Please study carefully the prospectus approved by the Financial Supervisory Authority and the terms and conditions of the offering.

Documents

Offering Circular

Lamor’s Articles of Association of Company

Marketing brochure (in Finnish)

Interim report 1 January to 30 September 2021

Auditor’s review report for the period 1 January to 30 September 2021

Financial statements and report of the Board of Directors 2020

Auditor’s report 2020

Financial statements and report of the Board of Directors 2019

Auditor’s report 2019

Financial statements and report of the Board of Directors 2018

Auditor’s report 2018

Releases

Company release

7 December, 2021

The initial public offering of Lamor on First North Premier has been oversubscribed and the listing will be completed as planned

Company release

25 November, 2021

Lamor applies for its shares to be listed on Nasdaq First North Premier Growth Market Finland

Press release

25 November, 2021

The Finnish Financial Supervisory Authority has approved Lamor’s Finnish language prospectus

Press release

24 November, 2021

Lamor announces the subscription price for its contemplated IPO and further information on the listing of its shares on Nasdaq First North Premier Growth Market Finland

Press release

11 November, 2021

Lamor contemplates launching an initial public offering and listing on Nasdaq First North Premier Growth Market Finland

Stay in the know

Sign up for our newsletter to learn more about innovations enabling the survival of our dear planet.